The greatest and common interest of all household into the India are to reside in the dream household. However, having genuine-home pricing skyrocketing, it is extremely difficult for those to cover a property out of pocket. Finance companies and you may low-banking boat finance companies give 2 kinds of financing affairs to aid anyone read their residence aspirations: home loans and you will house structure financing. These two loans offer big financial help to those searching to get a property.

But what ‘s the big difference in the 2 mortgage models? Exactly what are the keeps, qualifications requirements, and you may loan categories to take on? This informative article responses most of these concerns and. Why don’t we make this people come.

Mortgage brokers against. Structure Money An evaluation

Today, it is relatively simple becoming a homeowner. Any type of types of household you want to get, you can aquire the required finance by using away property financing. Banks and houses boat loan companies offer numerous mortgage brokers. If or not we wish to purchase a prepared-to-move-for the apartment, an around-construction property, make property into a parcel of land, otherwise redesign your current family, you will find the right financial to your requirements. Alternatively, most borrowers rating confused between home financing and you will property build mortgage. As the a few be seemingly equivalent, there are lots of distinctions one to consumers need certainly to envision when deciding on this new right type of home loan.

What is actually Financial?

Home financing is largely a contract between you and brand new financial to help you obtain a certain number of cash in acquisition to help you pick a home. Your invest in pay back the borrowed funds along with attention over a-flat period of time arranged by you in addition to financial. According to the bank, you could potentially choose between a predetermined-rates mortgage and you will a varying-rates mortgage. A home loan even offers you that have income tax experts less than Point 80C of Taxation Act on your dominating parts. You can make use of taxation vacations on the appeal repayments less than Point 24(b) of your own Taxation Work.

What’s Home Structure Financing?

A property build loan is one where the lender even offers to pay for the expense of developing a special domestic. You might either create your family for the the new home otherwise make a fraction of your residence on the current assets. This home construction mortgage is offered by a fixed interest speed for a flat time period. You might modify the title of one’s construction loan based on debt capability to pay-off. Your loan try safeguarded while the house is mortgaged. There are numerous style of design loans, like the following:

This type of funds also are also known as one to-intimate loans. They provide money needed to construct your permanent financial because the well as your real estate loan.

House build funds, such as home loans, has actually taxation masters. You could allege experts on your own prominent and you will desire around Parts 80C and you can 24(b) of the Taxation Act, correspondingly.

Home loans Versus. House Framework Funds

Now that you’ve got learned the latest meanings regarding lenders and you can domestic structure money, it’s time to enjoy deeper knowing the differences among them. The second table measures up the two sorts of finance considering some parameters.

Application for the loan Process

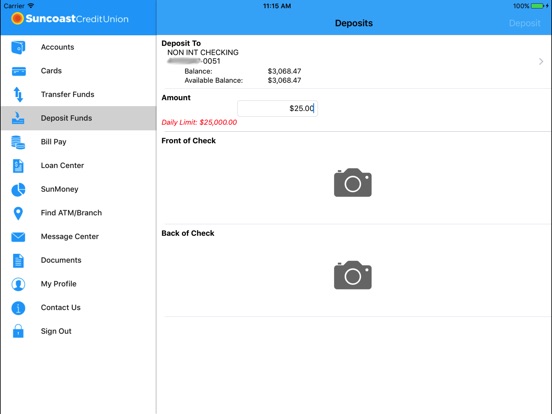

In terms of a standard mortgage, you could potentially submit an application for they either off-line otherwise on the web. The application processes to have a home loan is easy. Merely visit the lender’s web site or actual venue and you can fill aside home financing application form. The lender will guarantee the house or property and you will transfer the mortgage number right to the new builder otherwise provider.

Yet not, should you want to make an application for a house build financing, the process is more challenging. You need to earliest determine whether a loan provider has to offer a home framework financing and you will, in that case, precisely what the qualification requirements is. House build finance are typically not available on the internet as they want comprehensive paperwork and you will files.

Conditions to possess Qualifications and you may Paperwork

Lenders typically give lenders that have simple qualifications conditions and you may minimal paperwork. What you need to would was fulfill some elementary standards particularly since age, monthly earnings, credit score, etc, and complete several easy data such as your Pan card, Aadhar credit, and lender comments. Even though you can be found in this new financially disadvantaged class, you can get home financing (EWS).

The qualifications requirements and you will papers having household build fund, on top of that, was strict and day-consuming. A property framework mortgage is available for folks who very own good plot of land or a construction property and want to build a different home.

Files needed for property build mortgage include the Municipal Organization’s judge agreement files, a casing construction out of an architect otherwise civil engineer https://paydayloanalabama.com/greenville/, a blueprint of your build, and tax distribution data files, and others.

The interest rate

One thing to recall is the fact not absolutely all loan providers render household design loans. And those that create generally speaking costs a top interest. Rates on domestic framework financing generally are normally taken for 10% and you may fourteen% a-year.

Financial interest levels, as well, are particularly reasonable and you will competitive. When you look at the Asia, almost all financial institutions and you will non-banking financial companies (NBFCs) provide mortgage brokers. One more reason ‘s the government’s Pradhan Mantri Awas YoAY) plan, which makes home loans affordable. The newest annual rate of interest with the a mortgage vary anywhere between 6% and you will ten%.

The brand new Loan’s Stage

The latest 4th and you can finally difference between both of these variety of funds is their loan tenure. Home loans are typically higher-well worth financing since they are regularly purchase a home. Because of this, lenders might have regards to doing 30 years.

House design finance, in addition, are available for a shorter time frame than just lenders. Domestic framework finance routinely have terms anywhere between 7 to help you fifteen age.

The newest Similarities between Lenders and you will Household Framework Funds

Even though the goal and mission of these financing activities differ, there are parallels. Loan providers pursue an identical financing approve techniques if or not your sign up for a home loan or property structure financing. In addition, the fees selection and you will co-applicant guidelines are the same both for.

Conclusion:

Since you may has actually suspected, there should be zero confusion within the determining between a home loan and a property Framework Mortgage because they suffice various other objectives. The home Mortgage is best if you are planning to purchase good created assets or a house which is still under build off a builder. If, likewise, you need to make your residence, you really need to squeeze into property Build Loan. Any kind of alternative you choose, we recommend that you run extensive look and you will examine certain finance companies and NBFCs in advance of buying a loan provider.